Sahyog Schemes

Sahyog vehicle Loan

| Loan Amount | Maximum Rs. 70000/- or 70% of vehicle cost w.e. is higher | ||||

|---|---|---|---|---|---|

| Tenure | Maximum 18 Months | ||||

| Eligibility | 1. Person should be member of the society. 2. Borrower of the loan must have recurring deposit account for at least 1% of loan amount. |

||||

| Guarantor | Guarantor should be member of society , he must be government employee or another member of the society who should have at least deposit in the employee equal to 25 % of loan amount ,on which lien of society will be marked till the deposit of the borrower is equal to 25 % of loan amount or till maturity of loan tenure. | ||||

| Mode of Repayment | PDC/NPDC in case of NPDC Rs 2000 will be charged as NPDC charges. | ||||

| Repayment | PDC/NPDC |

||||

| Rate of interest | 14% per annum | ||||

| Penalty Clause | At maturity of the loan tenure if all the dues / penalty / interest / principal is not paid those will attract interest @2% p.m. flat for each month or part there of | ||||

| Charges Structure | Delay Payment | Delay payment will be charged at 2% per month for the amount due |

|||

| Cheque Bounce Charges | Rs 500 per bounce |

||||

| Cheque swap charges | Rs 1000 per swap |

||||

| NPDC Charges | Rs 2,000 |

||||

| Visit charges of delayed emi cases | Within city, Rs. 75 (per visit) |

||||

| Visit charges of regular cases | Society if it thinks fit can charge collection charges for regular cases whose collection was done by society officer by visiting the customer place , but the same can not exceed rs 50 per collection | ||||

| Fore Closure Charges | The society will charge 5% of the principal loan amount outstanding for prepayment or foreclosure of loan account. | ||||

| Insurance | Borrower | Borrower will be insured , for which the premium will be paid by borrower only. | |||

| Vehicle | Two wheeler will be insured through society , whose premium will be paid by borrower. | ||||

| Following documents are required for witness: | Photographs of the borrowers and guarantors Stamp papers of rs. 100/- (one hundred only) : Borrower Stamp papers of rs. 20/- (twenty only) : Guarantor Identity proof of the borrower and guarantor. insurance copy of the vehicle. registration copy of the vehicle. in case of vehicle loan |

||||

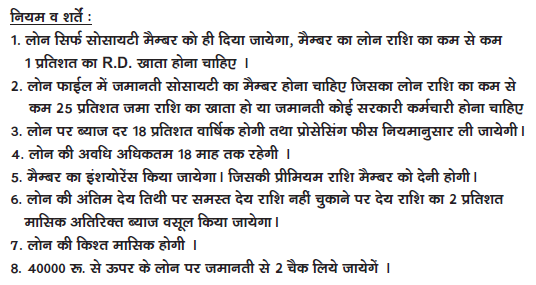

Terms & Conditions:

|

|||||

Sahyog Personal Loan

|

Sahyog Consumer Loan

| Loan amount | Minimum | Rs. 5000/- | ||

|---|---|---|---|---|

| Maximum | Rs. 50000/- | |||

| Tenure | Minimum | 6 Months | ||

| Maximum | 12 Months | |||

| Eligibility | Only daily earner or business man are eligible for this loan | |||

| Guarantor | There shall be one guarantor for this loan account who shall be member of the society and should have deposit with society for 10% of the loan account. | |||

| Requirement | 1. Applicant should have the daily deposit account in the society. 2. Minimum amount of daily deposit shall be .02% of proposed loan. |

|||

| Repayment | Repayment of loan shall be on daily basis. | |||

| Rate of interest | 16% flat p.a | |||

| Loan foreclosure | No interest will be waived off if loan is pre closed | |||

| Penalty clause | 1. In case applicant stop repayment in his daily deposit account after loan disbursed , then 10% of daily saving account will be charged as penalty. 2. At maturity of the loan tenure if all the dues / penalty / interest / principal is not paid those will attract interest @2% p.m. flat for each month or part there of |

|||

Sahyog Ladies Group Loan

| Details | Loan is Available against the deposit of Customer except deposit in DDS , Gullak & Saving Accounts. | |||

|---|---|---|---|---|

| Loan Amount | Loan is Available for maximum of 80 % of Deposit Amount. | |||

| Tenure | Maximum Tenure is same as equal to Tenure of Deposit. | |||

| Eligibility | All the Depositor having deposit product except DDS , Gullak , Saving Account. | |||

| Requirement | While Taking Loans , The Original Deposit Certificates / copies shall be submitted to the Society |

|||

| Repayment | Repayment of Loan shall be on Monthly / Tenure Basis . | |||

| Rate of interest | 16% flat p.a | |||

| Processing Fees | No Processing Fees is charged in Loan Against Deposits | |||